[Busan, Republic of Korea, 25 August 2025] – The Urban Transitions Mission (UTM) has launched its new publication, Blending Finance for Net-Zero, Resilient and Inclusive Cities, at the Clean Energy Ministerial 16 and Mission Innovation 10 (MI10/CEM16) convened in Busan, Republic of Korea.

This new and groundbreaking publication underscores the pivotal role of innovative finance in the clean energy transition in cities and offers actionable recommendations on how to tap into urban potential using blended finance.

Cities are at the forefront of the climate and energy challenge. Most of them across the world are starting to look into raising their ambition and setting net-zero targets to make their communities not only more resilient and inclusive, but also more sustainable.

Even though these ambitions continue to grow, cities are still facing many challenges when it comes to climate finance. While urban climate finance has grown to USD 831 billion annually, it falls far short of the USD 4.5 trillion needed each year by 2030 to achieve global climate goals.

“When we ask local leaders what’s needed to mobilize local action on climate and energy, the first answer is usually finance!” shared Andy Deacon, Co-Managing Director of the Global Covenant of Mayors for Climate and Energy (GCoM), a co-leading partner of the Urban Transitions Mission, as he officially unveiled the publication “Public finance alone cannot fill that gap, and the private sector has a vital role to play.”

Many cities have already developed a strong pipeline of projects that are ready for investment, yet they often face challenges in translating these portfolios into concrete actions on the ground.

This is the very question the Urban Transitions Mission grapples with every day: how do we transform a shared vision for a net-zero world into tangible outcomes that truly improve people’s lives?

To make this shift possible, private and commercial capital must play into the picture.

This is why the Urban Transitions Mission is exploring how to better mobilize private sector investment and how to blend it effectively with public capital to drive this transition forward.

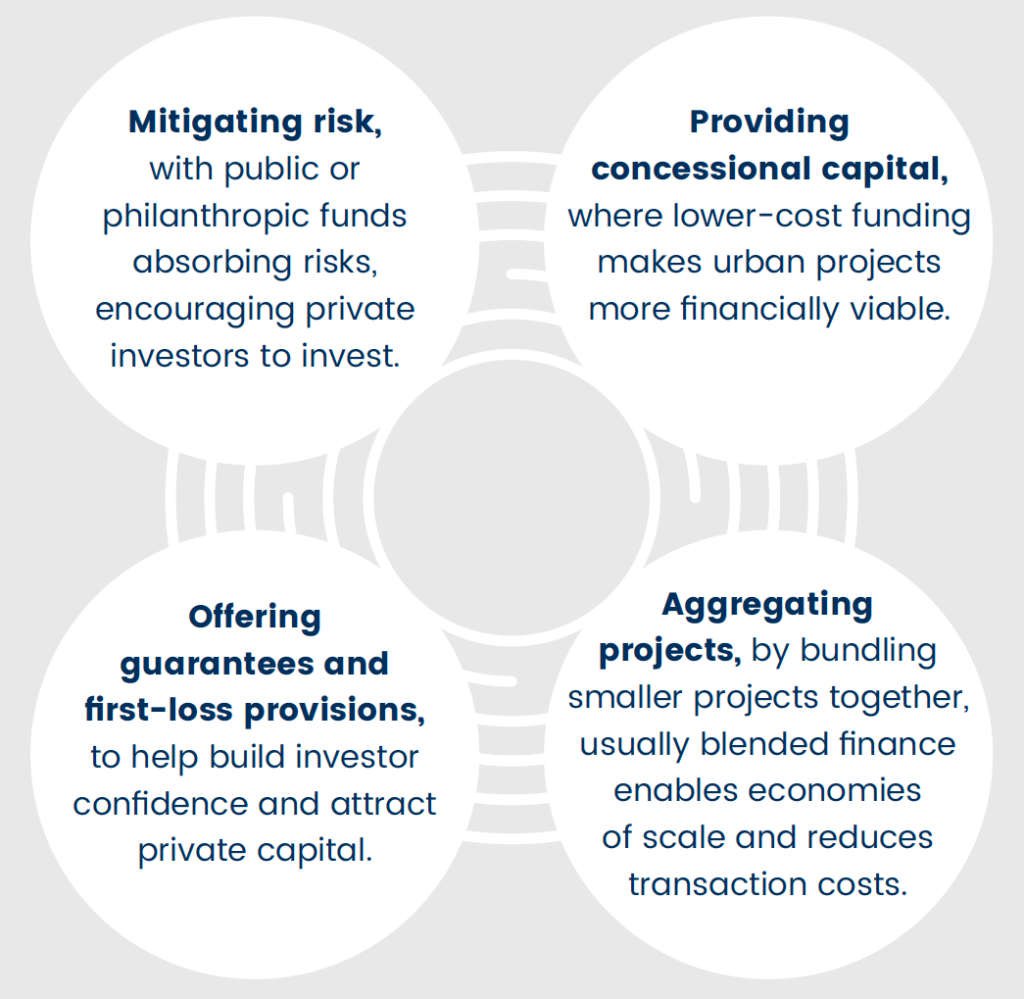

One of the key answers UTM is putting on the agenda through this publication is the use of blended finance tools and structure.

The UTM Finance & Funding Helpdesk, managed by co-author Nicola Iezza, has identified a pipeline of 255 projects with an overall investment potential of $5.5 billion to be found via blended finance.

The story is clear:

Blended finance — the strategic use of concessional capital to mobilize private investment — offers a powerful solution for cities.

The publication explores how national governments and city leaders can deploy blended finance to de-risk investments, attract private capital, and scale urban climate projects. Just as it is already helping cities from Pune to Greater Manchester strategically combine public and private capital to de-risk projects.

“No one size fits all that’s why local action and that’s why we need to learn fast and knowledge need to be shared,” elaborated Damitha Adikaari, Dr. Director for Climate Science and Energy Innovation at the Department for Energy Security and Net Zero, United Kingdom.

Additionally, it draws on the UTM city cohort as a benchmark to identify practical recommendations for national policymakers. It builds on the already existing collaboration between the private sector and cities, as implemented by UTM.

“We need credibility, stability and commitment when it comes to climate goals to bring in investment,” stated Abigail Binay, former Mayor of Makati, Philippines. “Money comes in with trust! Private investment comes in only when you have a bankable project and strong credit readiness through consistent capacity.”

Damitha Adikaari, Abigail Binay and Andy Deacon spoke during the Innovation Action Forum fireside chat Mayor-Minister Dialogue: Attracting private capital in urban infrastructures, held in Busan on August 26.

This publication found its impulse in the concrete day-to-day experiences of cohort cities.

“UTM helps to significantly increase cities’ readiness to engage with blended finance opportunities and build resilient, net-zero urban futures, offering not just support—but structure, scale, and strategic vision,” explained UTM Director Giorgia Rambelli ahead of the launch.

Key highlights from the publication include:

- Concrete pathways for how blended finance can unlock investment for low-carbon, climate-resilient urban infrastructure.

- Case studies from across the world — from Surat (India)’s pioneering green bonds to Greater Manchester (UK)’s innovative pooled housing funds, to Quebec’s blended rail investment model.

- Four key findings as presented by authors Giorgia Rambelli, Director of UTM and Andy Deacon, Co-Managing Director, Global Covenant of Mayors for Climate & Energy. Listen here.

- Ten recommendations for national governments

National governments can support cities and really capitalize on the “urban opportunity” by:

- Supporting the creation of platforms for blended finance and helping establish new pooling mechanisms that bring together private capital with public funding and interest.

- Helping de-risking investment by helping cities to attract patient capital or issuing guarantees.

- Improving cities’ knowledge and capacity to understand and apply blended finance mechanisms and support cities’ collection of data, monitoring and implement high-quality standards.

The launch of this publication marks a cornerstone of UTM’s 2025 end of year strategy to accelerate investment, strengthen its role as an implementation space, and act as a solution broker for cities worldwide.